The Malaysian Institute of Accountants (MIA) has released the second edition of the Illustrative MPERS Financial Statements, with Commentaries and Guidance Notes (Illustrative MPERS Financial Statements).

The Illustrative MPERS Financial Statements is part of MIA’s efforts to advocate higher quality financial reporting and to support the implementation of the Malaysian Private Entities Reporting Standard (MPERS) Framework and the new Companies Act 2016. This book also supports MIA’s agenda of growing the localised accountancy knowledge base by making available more technical accountancy literature that is applicable for the Malaysian context.

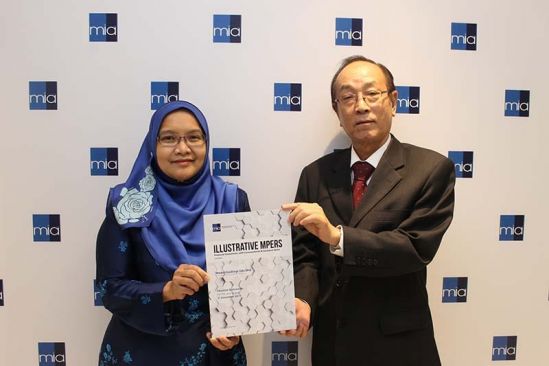

Mr. Tan Liong Tong, a Technical Consultant to Mazars Malaysia and an MIA member, is the author of the Illustrative MPERS Financial Statements, with support from key technical committee members and technical staff of MIA. Mr. Tan was previously an Associate Professor at the Graduate School of Management, Universiti Putra Malaysia and a former Technical Consultant to the Malaysian Accounting Standards Board (MASB).

Why MIA Published the Second Edition

“The Institute is committed to updating the Illustrative MPERS Financial Statements from time to time to reflect changes to MPERS and the laws affecting the financial accounting and reporting of private entities,” said MIA CEO Dr. Nurmazilah Dato’ Mahzan. The first edition titled the “Illustrative MPERS Financial Statements, with Commentaries”, was released in March 2016 to guide members in their transition to the MPERS Framework that became effective for financial statements of private entities beginning on or after 1 January 2016.

Two recent key developments necessitated the publication of this follow-up second edition, explained Dr. Nurmazilah. Firstly, the Malaysian Accounting Standards Board (MASB) issued the Amendments to MPERS (2015) in October 2015 and these amendments become effective for financial statements beginning on or after 1 January 2017. The Amendments to MPERS (2015) is an adaptation of the Amendments to IFRS for Small and Medium-Sized Entities issued by the International Accounting Standards Board (IASB) in 2015.

Secondly, the new Companies Act 2016 became effective for the financial year / period ended on or after 31 January 2017. Among other changes, the new Companies Act 2016 introduces a no-par value share regime that requires all shares issued before or after the commencement of the Act to have no par or nominal value.

Content of the Second Edition

The second edition of the Illustrative MPERS Financial Statements includes the Amendments to MPERS (2015) and the accounting and reporting requirements of the new Companies Act 2016, including shares issued with no par value, redemption of preference shares and capital maintenance, capital reduction, distribution of profits and solvency requirements. Wherever applicable, commentaries and guidance notes are added in the Illustrative MPERS Financial Statements to highlight certain principles, standards or laws and for comparison with the Malaysian Financial Reporting Standards (MFRS) Framework or the previous Private Entities Reporting Standards (PERS) Framework.

This second edition also features useful Appendices to explain the measurement and accounting procedures of debt instruments at amortised cost model, compound financial instruments, redeemable preference shares, financial guarantee contracts, service concession arrangements, bearer plants measured on cost model, consumable biological assets measured on fair value model and shares issued with no par value, areas which are new, or which may be complex to private entities applying MPERS.

“This edition also features a new Guidance Notes section that covers the Amendments to MPERS (2015), Accounting and Reporting Requirements of the new Companies Act 2016, No-Par Value Shares and Other Capital Requirements of the Companies Act 2016, Accounting for Investment Property and Valuation of Unquoted Equity Instruments. The views expressed in these Guidance Notes are mine and not the official views of the Institute,” said Mr. Tan.

The book also includes “Supplementary Illustrative MPERS Financial Statements” for a single entity to illustrate simple financial statements for most small and medium-sized private entities.

Where to purchase the publication

The publication is available at RM67 for MIA members and RM75 for non-MIA members. Copies of the publication can be purchased from the MIA Head Office in KL or via mail order (postage and packaging fees apply).